Quality you can trust — over 400,000 loans funded

Applying is free and won’t impact your credit.

Looking for capital to purchase equipment, provide working capital, or buy commercial real estate for your small business? A business loan can be the perfect solution. Compare the best business loan options below including lines of credit, SBA loans, term loans, and other alternative forms of financing.

12+ years of serving small businesses.

75+ lenders in our network.

400,000+ businesses matched with business financing.

Lendio’s recommendations and reviews are selected by our team of lending experts who have worked directly with each funder in our network. While the lenders featured are all partners we work with, reviews are based on our team’s experience and a methodology with multiple criteria.

| Lender/Funder* | Type | Financing amount | Minimum time in business | Term | Minimum credit score | Time to Funds (After Approval) |

|---|---|---|---|---|---|---|

| Idea Financial | Line of Credit | $10k-$275k | 3 years | Up to 18 months | 650 | Same day |

| Headway Capital | Line of Credit | $5k-$100k | 1 year | 12, 18, or 24 months | 625 | Same day |

| Funding Circle | Term Loan | $25K – $500K | 2 years | 6 months to 5 years | 660 | As fast as 3 days |

| BHG Financial | Term Loan | $20k – $500k | 2 years | 3-12 years | 700 | As fast as 3 days |

| Cadence Bank | SBA 7(a) | Up to $5 million | 2 years | 7 to 25 years | 650 | As fast as 10 days |

| BayFirst Financial | SBA 7(a) | Up to $5 million | 2 years | 7 to 25 years | 650 | As fast as a few days |

| Ready Capital | SBA 7(a) | $350k to $7 million | 2 years | 7 to 25 years | 640 | As soon as 6 days |

| Balboa | Equipment Financing | Up to $500,000 | 1 year | 2-5 years | 620 | Same day |

| ClickLease | Equipment Financing | Up to $20,000 | None | 2-5 years | 520 | Same day |

| Kapitus | Business Cash Advance | Up to $5 million | 2 years | 6-24 months | 650 | 1 business day |

| OnDeck | Business Cash Advance | $5,000 to $250,000 | 1 year | 18-24 months | 625 | Same day |

| Gillman-Bagley | Invoice Factoring | $50K to $10 million | 3 months | 30 days | N/A | 1 business day |

| Eagle Business Funding | Invoice Factoring | Up to $5 million | None | None, they take on the invoice repayment | N/A | As fast as 48 hours |

APR range

Daily interest rate minimum of 0.685%

Funding amount

$10,000-$275,000

Term

Up to 18 months

Minimum credit score

650

Time to funding

As fast as 24 hours after approval

Idea Financial provides a line of credit to business owners who have been in business for at least two years and have a monthly revenue of $15,000 or more. They do not lend to sole proprietors or non-profits.

Pros:

Cons:

APR range

Daily interest rate minimum of 0.685%

Funding amount

$10,000-$275,000

Term

Up to 18 months

Minimum credit score

650

Time to funding

As fast as 24 hours after approval

Idea Financial provides a line of credit to business owners who have been in business for at least two years and have a monthly revenue of $15,000 or more. They do not lend to sole proprietors or non-profits.

Pros:

Cons:

Interest rate

Starting at 3.3% monthly

Funding amount

$5,000-$100,000

Term

12, 18, 24 months

Minimum credit score

625

Time to funding

As fast as 24 hours after approval

Headway Capital offers a true revolving line of credit. Their monthly payments and ongoing access to capital make it a great product for those who want to be able to access funds at any time. With their fast and easy application and funding process you can have funds in your account within one

business day.

Pros:

Cons:

Interest rate

Starting at 3.3% monthly

Funding amount

$5,000-$100,000

Term

12, 18, 24 months

Minimum credit score

625

Time to funding

As fast as 24 hours after approval

Headway Capital offers a true revolving line of credit. Their monthly payments and ongoing access to capital make it a great product for those who want to be able to access funds at any time. With their fast and easy application and funding process you can have funds in your account within one

business day.

Pros:

Cons:

APR range

15.22% to 45%

Funding amount

$25,000 to $500,000

Term

6 months to 7 years

Minimum credit score

660

Time to funding

As fast as 3 days after approval

For a term loan, consider applying with Funding Circle. The lender offers large loan amounts up to $500,000. However, their required 660 minimum credit score makes it more difficult to qualify for than some other online lenders.

Pros:

Cons:

APR range

15.22% to 45%

Funding amount

$25,000 to $500,000

Term

6 months to 7 years

Minimum credit score

660

Time to funding

As fast as 3 days after approval

For a term loan, consider applying with Funding Circle. The lender offers large loan amounts up to $500,000. However, their required 660 minimum credit score makes it more difficult to qualify for than some other online lenders.

Pros:

Cons:

APR range

Rates starting at 11.32%

Funding amount

$20k – $500K

Term

3-12 years

Minimum credit score

700

Time to funding

Approval in as little as 24 hours, funding in as little as 3 days

BHG Financial specializes in providing tailored financial solutions to professionals across various industries with a focus on healthcare practitioners. If you’re looking for a much longer-term loan, BHG Financial can offer businesses loans with up to 12-year terms. Licensed professionals can get a loan to start their practice if they have a personal annual income of $100K+.

Pros:

Cons:

3% origination fee

APR range

Rates starting at 11.32%

Funding amount

$20k – $500K

Term

3-12 years

Minimum credit score

700

Time to funding

Approval in as little as 24 hours, funding in as little as 3 days

BHG Financial specializes in providing tailored financial solutions to professionals across various industries with a focus on healthcare practitioners. If you’re looking for a much longer-term loan, BHG Financial can offer businesses loans with up to 12-year terms. Licensed professionals can get a loan to start their practice if they have a personal annual income of $100K+.

Pros:

Cons:

3% origination fee

APR range

Current prime rate + lender rate

Funding amount

$50k – $350k

Term

7 to 25 years

Minimum credit score

650

Time to funding

As fast as 10 days

Cadence Bank is an SBA-preferred lender. While it offers a variety of SBA loans, including SBA 504 loans, SBA Express loans, and CAPLines, its most popular products are SBA 7(a) loans. You can use the proceeds of a 7(a) loan to purchase or expand a business, invest in inventory and equipment, cover working capital costs, or refinance debt.

Pros:

Cons:

APR range

Current prime rate + lender rate

Funding amount

$50k – $350k

Term

7 to 25 years

Minimum credit score

650

Time to funding

As fast as 10 days

Cadence Bank is an SBA-preferred lender. While it offers a variety of SBA loans, including SBA 504 loans, SBA Express loans, and CAPLines, its most popular products are SBA 7(a) loans. You can use the proceeds of a 7(a) loan to purchase or expand a business, invest in inventory and equipment, cover working capital costs, or refinance debt.

Pros:

Cons:

APR range

Current prime rate + lender rate

Funding amount

Up to $5 million

Term

7 to 25 years

Minimum credit score

675

Time to funding

As little as a few days for BayFirst Bolt Loans (SBA loans up to $150,000) As little as 2 weeks for SBA loans over $150,000

BayFirst Financial is one of the top-producing SBA lenders in the country and offers a fast approval process as a preferred lender. The flagship product, the SBA 7(a) loan, is particularly aimed at businesses looking for long-term financing to grow, acquire another business, or refinance existing debts. These loans are funded through CreditBench, BayFirst’s SBA loan division.

BayFirst also offers BayFirst Bolt Loans, which provide up to $150,000 for working capital within days instead of weeks.

Pros:

Cons:

APR range

Current prime rate + lender rate

Funding amount

Up to $5 million

Term

7 to 25 years

Minimum credit score

675

Time to funding

As little as a few days for BayFirst Bolt Loans (SBA loans up to $150,000) As little as 2 weeks for SBA loans over $150,000

BayFirst Financial is one of the top-producing SBA lenders in the country and offers a fast approval process as a preferred lender. The flagship product, the SBA 7(a) loan, is particularly aimed at businesses looking for long-term financing to grow, acquire another business, or refinance existing debts. These loans are funded through CreditBench, BayFirst’s SBA loan division.

BayFirst also offers BayFirst Bolt Loans, which provide up to $150,000 for working capital within days instead of weeks.

Pros:

Cons:

APR range

Current prime rate + lender rate

Funding amount

$350k – $7 million

Term

7 to 25 years

Minimum credit score

640

Time to funding

As fast as 6 days

Ready Capital is a commercial lender that stands out for its dedication to helping small and mid-sized businesses expand, refinance, or acquire properties. Ready Capital offers SBA 7(a) loans up to $500K.

Pros:

Cons:

APR range

Current prime rate + lender rate

Funding amount

$350k – $7 million

Term

7 to 25 years

Minimum credit score

640

Time to funding

As fast as 6 days

Ready Capital is a commercial lender that stands out for its dedication to helping small and mid-sized businesses expand, refinance, or acquire properties. Ready Capital offers SBA 7(a) loans up to $500K.

Pros:

Cons:

Funding amount

Up to $500,000

Term

24, 36, 48, or 60 months

Minimum credit score

620

Time to funding

As soon as same day

Balboa Capital offers customers up to $500,000 in equipment financing. They do require some form of collateral for all of their financing options, but if you use them for financing equipment of less than $350,000, you’ll need only soft collateral.

Pros

Cons

Funding amount

Up to $500,000

Term

24, 36, 48, or 60 months

Minimum credit score

620

Time to funding

As soon as same day

Balboa Capital offers customers up to $500,000 in equipment financing. They do require some form of collateral for all of their financing options, but if you use them for financing equipment of less than $350,000, you’ll need only soft collateral.

Pros

Cons

Funding amount

Up to $20,000

Term

24-60 months

Minimum credit score

520

Time to funding

As soon as same day

ClickLease offers equipment financing for smaller purchases up to $20,000. ClickLease has flexible terms and rates for a variety of business owners.

Pros:

Cons:

One-time documentation fee

Funding amount

Up to $20,000

Term

24-60 months

Minimum credit score

520

Time to funding

As soon as same day

ClickLease offers equipment financing for smaller purchases up to $20,000. ClickLease has flexible terms and rates for a variety of business owners.

Pros:

Cons:

One-time documentation fee

Funding amount

Up to $5 million

Term

6 to 24 months

Minimum credit score

650

Time to funding

As little as 24 hours, once approved

Kapitus provides a business cash advance up to $5 million with a credit score requirement of 650 or higher. With a straightforward application process and the possibility of funding within 24 hours, Kapitus is designed to support businesses in seizing opportunities and overcoming challenges without the wait.

Pros:

Cons:

Funding amount

Up to $5 million

Term

6 to 24 months

Minimum credit score

650

Time to funding

As little as 24 hours, once approved

Kapitus provides a business cash advance up to $5 million with a credit score requirement of 650 or higher. With a straightforward application process and the possibility of funding within 24 hours, Kapitus is designed to support businesses in seizing opportunities and overcoming challenges without the wait.

Pros:

Cons:

Funding amount

$5,000-$250,000

Term

18-24 months

Minimum credit score

625

Time to funding

As fast as same day after approval

OnDeck offers a business cash advance of up to $250,000. Unlike other cash advance providers, OnDeck charges an interest rate instead of a factor rate and is a publicly traded company. OnDeck also offers a line of credit of up to $100,000.

Pros:

Cons:

Funding amount

$5,000-$250,000

Term

18-24 months

Minimum credit score

625

Time to funding

As fast as same day after approval

OnDeck offers a business cash advance of up to $250,000. Unlike other cash advance providers, OnDeck charges an interest rate instead of a factor rate and is a publicly traded company. OnDeck also offers a line of credit of up to $100,000.

Pros:

Cons:

Factor Rate

Varies

Funding amount

$50,000 to $10 million

Term

30 days

Minimum credit score

None, based on your accounts receivable

Time to funding

As soon as same day

Gillman-Bagley offers invoice factoring up to $10 million. They specialize in working with government contractors, manufacturing and other B2B companies.

Pros:

Cons:

Factor Rate

Varies

Funding amount

$50,000 to $10 million

Term

30 days

Minimum credit score

None, based on your accounts receivable

Time to funding

As soon as same day

Gillman-Bagley offers invoice factoring up to $10 million. They specialize in working with government contractors, manufacturing and other B2B companies.

Pros:

Cons:

Factor Rate

Varies

Funding amount

Up to $5 million

Term

No term, they take on your invoices

Minimum credit score

None, based on invoices

Time to funding

As little as 48 hours after approval

Eagle Business Funding offers invoice factoring up to $5 million. The company works with a wide range of industries including a division specializing in trucking and transportation.

Pros:

Cons:

No additional fees

Factor Rate

Varies

Funding amount

Up to $5 million

Term

No term, they take on your invoices

Minimum credit score

None, based on invoices

Time to funding

As little as 48 hours after approval

Eagle Business Funding offers invoice factoring up to $5 million. The company works with a wide range of industries including a division specializing in trucking and transportation.

Pros:

Cons:

No additional fees

There are many types of business loans available each with its benefits.

A business line of credit is a flexible and reliable revolving safety net for your business that allows you to borrow exactly what you need when you need it. You only pay interest on the funds you use, and once you repay what you’ve borrowed, your credit limit goes back up. It is perfect for managing cash flow hiccups, unforeseen expenses, or taking advantage of growth opportunities.

Best for: Working capital and other short-term needs.

Loan Amount

$1k-250K

Speed of Funds

1-2 days

Interest Rate

8%-60%

The SBA Loan, backed by the U.S Small Business Administration, offers a variety of loans designed to cater to an array of business needs. The 7(a) loan is the most flexible, assisting small businesses with anything from short-term working capital to long-term real estate development. The 504 loan is specifically tailored for major fixed asset purchases, such as land or machinery. Each option offers competitive interest rates, longer repayment terms, and lower down payments than traditional business loans.

Best for: Long-term business investments, purchasing machinery, real estate, or business expansion.

Loan Amount

up to $5M

Speed of Funds

1-3 months

Interest Rate

Prime+

A term loan provides a lump sum that gets repaid monthly over a set amount of time, also known as the loan term. These loans are great for businesses that need a substantial amount of money upfront and prefer predictable payments. They are commonly used for long-term investments, such as purchasing equipment or real estate, expanding your business, or refinancing existing debt.

Best for: Long-term investments, refinancing debt, and other one-time expenses.

Loan Amount

$5k-5M+

Speed of Funds

As soon as 24hrs

Interest Rate

As Low as 8.49%

Use this loan to purchase any kind of equipment your business needs. There are financing options for nearly every industry and business equipment you need. Financing agreements can be structured similarly to a term loan or as a lease with varying options to purchase the equipment at the end of the lease.

Best for: Businesses needing industrial equipment.

Loan Amount

5k-5M

Speed of Funds

As soon as 24hrs

Interest Rate

As Low as 7.5%

Use it to buy, build, expand, remodel, or even refinance your business. A commercial mortgage is similar to a residential mortgage, but it’s specifically designed for commercial properties. These loans have fixed or variable interest rates and are secured by the purchased property.

Best for: Long-term investment in commercial real estate.

Loan Amount

$250k-5M+

Speed of Funds

1-2 months

Interest Rate

As Low as 5.70%

Microloans are small loans typically ranging from $500 to $50,000, designed for small businesses that may not qualify for traditional loans. They are often used for working capital, inventory purchases, or start-up costs. These loans are particularly beneficial for minority-owned businesses and those in underserved communities.

Best for: Start-up businesses, minority-owned businesses, and underserved communities.

Loan Amount

$500 – $50,000

Speed of Funds

1 month

Interest Rate

As Low as 8%

There are multiple business financing options outside of traditional business loans.

Accounts receivable financing, often referred to as invoice factoring, works by providing your business with immediate capital in exchange for your outstanding invoices. A factoring company buys your account receivables and pays you a substantial portion of the amount upfront, typically around 80-90%. The remaining balance, minus a factoring fee, is paid to your business once your customer settles their invoice with the factoring company.

Best for: Businesses with outstanding invoices that are hindering cash flow.

Loan Amount

Tied to receivables

Speed of Funds

As soon as 24hrs

Interest Rate

as low as 3%

A business cash advance offers businesses swift access to funds in exchange for a portion of future sales. Think of it as selling a slice of your future earnings today. Payments are withdrawn daily from your business bank account based on a fixed percentage. This type of financing is particularly suitable for businesses with irregular or seasonal cash flow. Moreover, it is more accessible than traditional loans, making it a popular choice for businesses that may not qualify for other forms of financing.

Best for: Businesses that need a quick influx of cash.

Loan Amount

$5k-1M

Speed of Funds

As soon as 24hrs

Interest Rate

As Low as 18%

A business credit card gives you easy access to capital for everyday expenses and can build your business credit history. Plus, many business credit cards offer cashback or rewards programs that can help offset business expenses.

Best for: Small, ongoing expenses and building credit history.

Loan Amount

Up to $150K

Speed of Funds

2-4 weeks

Interest Rate

Up to 31%

The government offers several other loan options for specific use cases.

Funded by the United States Department of Agriculture, these programs can support a variety of purposes, including business expansion, refinancing, and working capital.

Here is a quick overview of some of the key USDA business loan programs:

1. Business and Industry Loan Guarantees (B&I): The B&I program helps create jobs and stimulate rural economies by financially backing rural businesses. This program helps mitigate risk for lenders, making it easier for businesses in rural areas to get the capital they need for operations, growth, or modernization.

2. Rural Energy for America Program (REAP): REAP provides guaranteed loan financing to rural small businesses for renewable energy systems or to improve energy efficiency.

3. Intermediary Relending Program (IRP): The IRP offers low-interest loans to local intermediaries who re-lend to businesses to improve the economy in rural communities.

The Export-Import Bank of the United States (EXIM) Working Capital Loan Guarantee is a specialized financial solution designed to support U.S. businesses involved in international trade. This program aids businesses by covering their short-term working capital needs, such as inventory purchases, manufacturing costs, or even payment to suppliers.

The beauty of this program lies in its structure – instead of directly lending money to businesses, EXIM provides a guarantee to the lenders, covering up to 90% of the loan amount. This guarantee reduces risk to the lender, making it easier for businesses to secure financing.

These loans are offered to businesses affected by declared disasters. They provide the capital needed for businesses to recover and rebuild.

The Small Business Administration (SBA) provides various types of disaster loans to cater to different business needs during and after declared disasters. These include:

FSA loans cater to farmers and ranchers, providing the necessary funding for various agricultural activities.

Common types of FSA loans include:

The ILGP is designed to assist American Indian or Alaskan Native-owned businesses. The program provides loan guarantees to eligible borrowers, encouraging lenders to extend credit to businesses that may otherwise struggle to secure financing.

To qualify for the Indian Loan Guarantee Program (ILGP), the business must be at least 51% owned by a federally recognized American Indian tribe or Alaskan Native corporation, or an individual who is an enrolled member of such a tribe or corporation.

The eligibility criteria for obtaining funding may differ based on the type of loan and the lender.

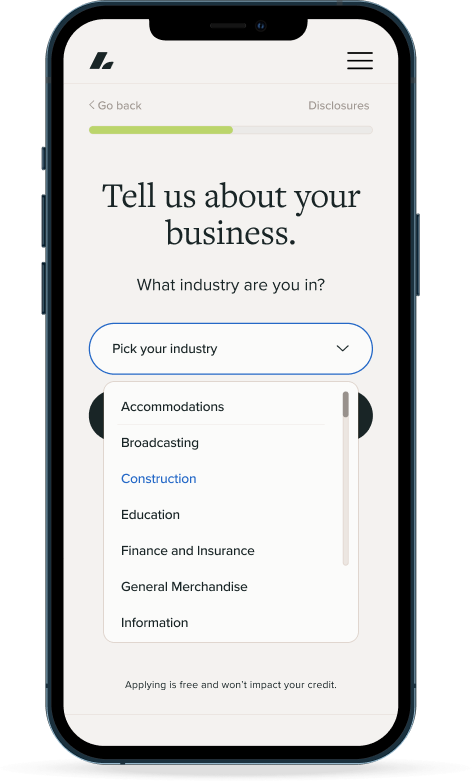

Securing a small business loan can help entrepreneurs propel their ventures to new heights. Here are the essential steps to guide you on this journey:

Take 15 minutes to find out what you qualify for from 75+ lenders.

Answer a few simple questions and complete the application in minutes.

We’ll put your application in front of 75+ lenders. Applying is free and won’t impact your credit score.

Find the funding option with the terms that best fit your small business goals.

Once you accept, funding can hit your bank account in as little as 24 hours.

Small business owners take out business loans either through banks or online lenders. Amounts and loan requirements can vary quite significantly. The business owner will repay the loan over a set period along with any associated interest and fees.

It is possible to get certain types of business financing with a lower credit score. For example, some business cash advance funders will allow for a minimum credit score in the 500s. Just know that with a lower credit score, lenders typically look for a longer time in business and higher monthly revenue.

If you are not approved for a small business loan, look at the reason given by the lender. Reasons can vary from too little revenue to it being too soon to qualify for a second loan. Since requirements vary significantly, consider applying with a different lender or loan product.

The credit score required to qualify for a business loan can vary significantly depending on the type of loan and the lender. However, as a general rule, lenders often look for a credit score of 600 or higher for traditional loans. Some types of loans, like the SBA 7(a) loan, may require a higher credit score, typically around 650 or above. On the other hand, some alternative lenders may have more flexible credit requirements, with minimum scores as low as 500.

Obtaining a business loan for a brand-new business can be quite challenging. However, startups can still get equipment financing right from the day they launch their business. Depending on their monthly revenue and credit score, they may qualify for cash advances, accounts receivable financing, or a line of credit within 3-6 months of starting their business.

Wondering how we chose the best? We used the following criteria to evaluate the lenders in our network.

*The information contained in this page is Lendio’s opinion based on Lendio’s research, methodology, evaluation, and other factors. The information provided is accurate at the time of the initial publishing of the page (May 10, 2024). While Lendio strives to maintain this information to ensure that it is up to date, this information may be different than what you see in other contexts, including when visiting the financial information, a different service provider, or a specific product’s site. All information provided in this page is presented to you without warranty. When evaluating offers, please review the financial institution’s terms and conditions, relevant policies, contractual agreements and other applicable information. Please note that the ranges provided here are not pre-qualified offers and may be greater or less than the ranges provided based on information contained in your business financing application. Lendio may receive compensation from the financial institutions evaluated on this page in the event that you receive business financing through that financial institution.