Business term loans to grow your business.

The classic way to boost your small business with monthly payments and access to funds in as little as 24 hours.

Is a term loan right for you?

Term loans can help grow your business by providing a predictable payment schedule, lower interest rates, and longer term lengths. With term loans, you can plan your finances more effectively, make accurate projections, and budget accordingly.

Cons of a business term loan.

How can I use my loan?

- Fund a business acquisition.

- Purchase or upgrade equipment and software.

- Hire new employees.

- Cover payroll gaps.

- Remodel your property.

- Refinance debt.

Business term loan comparison.

QuickBooks – Term loan*

*QuickBooks Term Loan is issued by WebBank.

**Loans are typically deposited within 1-2 business days. Actual funding time can vary depending on third party processing time.

Funding Circle – Term loan

*BHG Financial Commercial Loans Disclosure

BHG Financial – Term loan

*BHG Financial Commercial Loans Disclosure

Avana Capital (Lend Thrive) – Term loan

Camino Financial – Term loan

Dreamspring – Term loan

Fundation – Term loan

Lighter Capital – Term loan

Salaryo – Term loan

Minimum requirements for a business term loan.

*Qualification criteria, rates, and other funding terms will vary depending on the type and location of your business, and upon other factors. This is not a guarantee of funding, and it should not be relied upon as an accurate assessment of the availability or terms of the represented funding products.

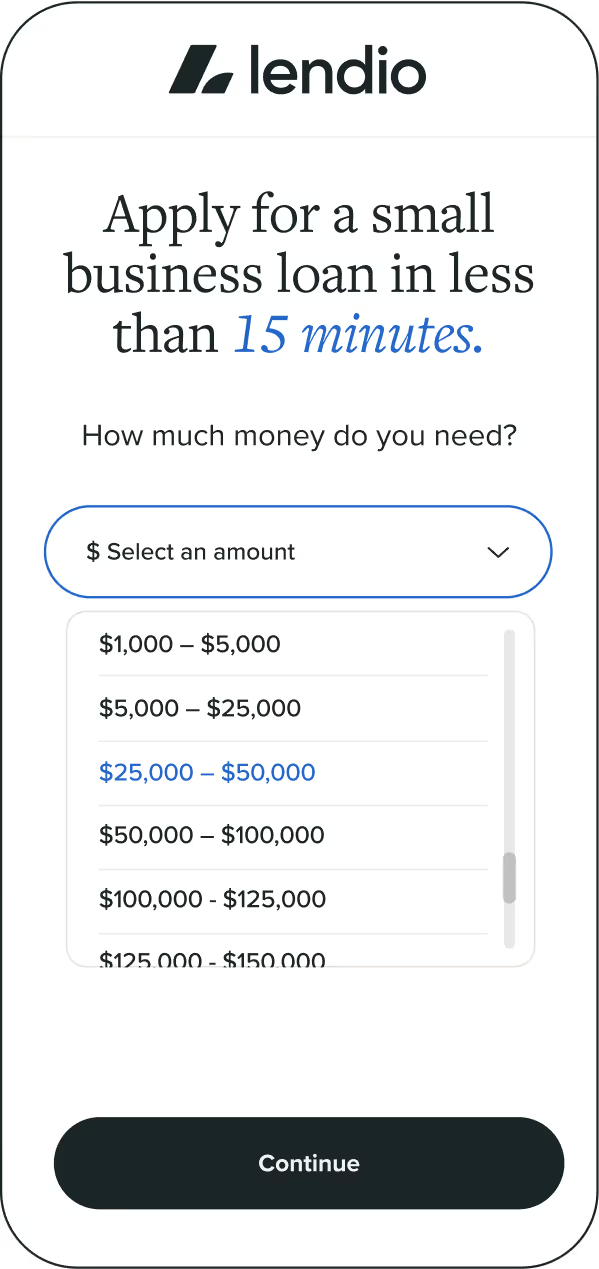

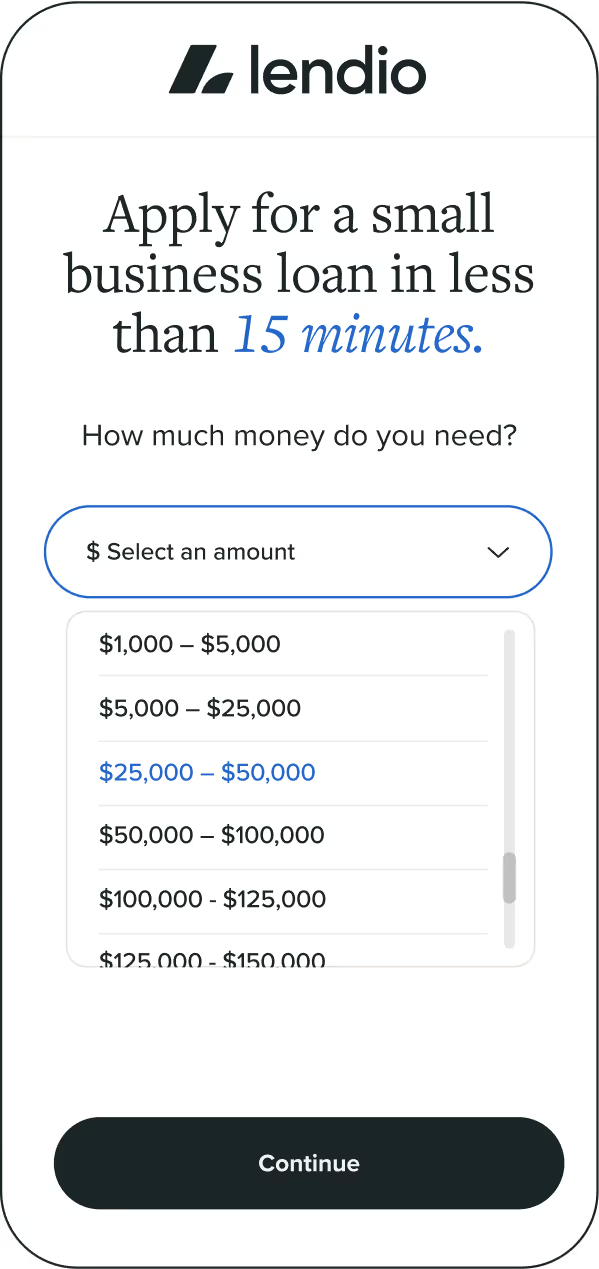

Four simple steps to funding.

Tell us about your business.

Answer a few simple questions and complete the application in minutes.

Submit your application.

We’ll present your application to our marketplace 75+ lenders. Applying is free and won’t impact your credit score.

Compare offers.

Find the funding option with the terms that best fit your small business goals.

Get funded.

Once you accept, funding can hit your bank account in as little as 24 hours.

14+ years of serving small businesses.

Get the answers and the funding you need with support all along the way.

in small business funding facilitated in the last decade.

21,500 Trustpilot® reviews.

50% repeat customers.

total small business loans funded in the last decade.

FAQs

Find answers to some commonly asked questions about business term loans.

A term loan provides a borrower with a lump sum of money upfront that is then repaid at regular intervals over a set amount of time, also referred to as the loan term. Interest rates on term loans can be fixed or variable.

One of the best things about a term loan is that it can be used for a variety of funding needs. Here are some examples of how you can use your term loan:

Payroll gaps

You can use a small business term loan to cover a payroll gap you’ve got to cover. You might have one because your business is seasonal. Or you might have one because you had a rush of business and had to bring on new employees to help cover it all. Either way, you can use a term loan to pay.

Adding another business location

If you’ve got one brick-and-mortar business location that’s thriving, the opportunity to open another might be too good to pass up. You could use a term loan to help you cover the startup costs of your new location. Renovations, rent, and materials for running your business all cost money a term loan could help provide.

Marketing

Word-of-mouth advertising is great, but it only gets your business so far. You likely need to market your business at times and term loan funding can help you do that.

Acquiring another business

Another way term loans could help your business is if you’ve got the chance to acquire another business. If there’s one that comes on the market and would be the perfect addition to your existing business, don’t miss out. You can use a term loan to help acquire it.

The interest rates for term loans tend to be lower than other kinds of quick financing. The exact rate will vary by lender and the loan terms. Don’t forget to add any origination fees or application fees to the total cost of the loan.

Term loans are best used for one-off expenses like investing in equipment, real estate, or working capital. Because term loans can be approved relatively quickly, they are a great way for businesses to fund essential projects or expansions to grow their business long-term. If you need money for a big project with solid ROI potential, a term loan can be a good option.

Well-established businesses with a solid history of strong financials and healthy revenue are a good match for term loans. Lenders are looking for borrowers who can demonstrate reliable income and repayment through strong credit and financial history.

Newer businesses or startups with less than two years in business are unlikely to be a good match for term loans—they simply don’t have the financial history yet to prove they are a safe bet for lenders.

Term loans have advantages and drawbacks—which loan is right for you will depend on your own business goals and how well you meet eligibility criteria. Weigh the pros and cons carefully to understand if a term loan is right for you.

Pros of term loans.

Predictable payment schedule

Term loans are lump sum funds with a set repayment schedule, which means you’ll always know when payments are due and how much is owed. This predictability makes it easier to plan your finances, make more accurate projections, and budget accordingly.

Lower interest rates

Long-term loans typically have lower interest rates compared to other financing options, making them a more affordable option for businesses. Additionally, because the loan is spread across a longer period, the monthly payments will generally be lower, resulting in less impact on cash flow from month to month. Plus, interest on term loans is tax deductible, putting more savings into your pocket.

Versatile short- or long-term financing options

Term loans offer flexible financing options for businesses, from short-term funding up to 18 months to longer terms anywhere from a few years to a decade or more.

Cons of term loans.

Inflexible payment schedule

The predictability of term loan payments can also be a disadvantage. Term loans have fixed repayment schedules and often have strict policies on early repayment. This means you must pay on time every month with little to no exceptions. And short term loans may have more frequent repayment deadlines with weekly or even daily payments. This can put a strain on a business if its cash flow is unpredictable.

Strict eligibility requirements

Because term loans typically deal with significant sums of money, lenders have stringent eligibility criteria. Borrowers should have an established business with strong finances and a good credit score.

Be prepared to share:

- Credit history

- Personal and business cash flow

- Annual business revenue

- Business plans

New businesses don’t have a long-established financial history to demonstrate secure cash flow and practices, so they are less likely to get approved.

Term loans are generally classified into short-term loans and long-term loans.

Short-term loan

These short-term loans have a fairly self-explanatory name. They’re short-term, generally meaning they are repaid over 18 months or fewer.

Medium-term loan

These are like short-term loans but with a longer repayment period, usually between one to five years. They’re great if you need a bit more cash and more time to pay it back.

Long-term loan

These are the big ones! They’re for larger amounts and have terms that can last anywhere from five to twenty-five years. They’re perfect for big investments like buying a new building or launching a new product line.

Business term loans are similar to personal loans. Let’s say you’re approved for a loan – you’d get a lump sum of cash upfront. Then, you’d pay it back over a set period, or “term,” with interest.

The great part? You can use this loan for any business expense. Need to buy equipment? Absolutely. Looking to expand your operations? Go for it. It’s all about helping you grow your business.

- Know your needs: First things first, you’ve got to understand what you need the loan for. It could be anything from expansion plans to inventory purchases. The key is to have a clear idea of why you need the loan and how much you need.

- Check your credit score: Lenders will look at your personal and business credit scores to assess your risk level. If it’s low, don’t worry. There are still options out there for you.

- Gather your documents: You’ll likely need to provide financial statements, tax returns, and a business plan. Make sure you’ve got all your paperwork in order.

- Compare lenders: Don’t just jump at the first offer you get. It’s important to shop around and compare terms from different lenders.

- Apply: Once you’ve chosen a lender, go ahead and submit your application. They’ll review it and make a decision.

- Close the deal: If approved, you’ll receive an offer. Review it carefully, ask any questions you might have, and if it all looks good – sign on the dotted line!

Remember, we’re here to help you through every step of the process. You’re not alone in this journey, and together, we’ll find the best solution for your business.

Ready for funding?

See what you can qualify for on the Lendio Marketplace.

%202.avif)